how to pay meal tax in mass

Paying the full amount of tax due with the appropriate Massachusetts meals tax return on time and. This meal break may be unpaid if and only if.

Craigslist Cars For Sale Used Cheap Used Cars Cheap Cars For Sale

Phone numbers for the Sales Tax division of the Department of Revenue are as follows.

. Sales of meals to Harvard faculty and staff are taxable. Navigate to the S earch S. Free Edition tax filing.

How often you need to file depends upon the total amount of sales tax your business collects. To learn more see a full list of taxable and tax-exempt items in Massachusetts. Also on August 1 the sales tax exemption currently in effect for beer wine and alcohol sold in package stores will be lifted and those items will be taxed as well at 625 percent.

If you need any assistance please contact us at 1-800-870-0285. Meals are sold by Harvard-operated dining facilities and. Massachusetts local sales tax on meals.

Be sure to check if your location is subject to the local tax. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625.

The payments must have a status of Submitted to be deleted. Businesses that paid less than 150000 in 2019 sales and meals or room occupancy taxes are eligible. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

29 will be eligible for tax relief state officials say. This page describes the taxability of food and meals in Massachusetts including catering and grocery food. Massachusetts Department of Revenue.

If you are just filing a use tax return you can use form ST-10. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Tax Department Call DOR Contact Tax Department at 617 887-6367.

How do I delete a payment. All online tax preparation software. Registering with the DOR to collect the sales tax on meals.

Sales and use Sales tax on services Meals tax Meals tax Room occupancy excise Marijuana retail taxes. Sales of meals to Harvard students are tax-exempt if. This is true whether you are based in Massachusetts or whether you are based in another state and have sales tax nexus in Massachusetts.

Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. To review all of the forms that Massachusetts has available for sales and use tax follow this link. This new rate will also apply to the sale of automobiles.

Beginning August 1 the sales tax and the meals tax will increase from 5 percent to 625 percent. LicenseSuite is the fastest and easiest way to get your Massachusetts meals tax restaurant tax. These small amounts add up to a sizable revenue source.

Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax. Thus a 40 restaurant tab generates 280 in meals tax of which 30-cents goes to a city or town that has enacted the local option. Deluxe to maximize tax deductions.

The meals tax rate is 625. If your business collects less than 833 in sales tax per month then your business should elect to file returns on an annual basis. To delete a payment i f the payment was made while logged into an MassTaxConnect account.

100 states No person shall be required to work for more than six hours during a calendar day without an interval of at least thirty minutes for a meal. You can learn more by visiting the sales tax information website at wwwmassgov. Advance payment requirements for.

625 of the sales price of the meal. Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625. MTF also looks at jurisdictional compliance and administrative issues that impact a taxpayers liability.

If you plan on dining out during the states sales tax holiday later this month youll still have to pay the 625 percent Massachusetts meals tax. The Massachusetts Sales Tax is administered by the Massachusetts Department of Revenue. Individuals may report and pay any Massachusetts use tax due on their personal income tax return Form 1 Form 1-NRPY for part-year residents.

TurboTax Live Tax Expert Products. TurboTax Live tax prep. Contact for Pay your personal income tax.

If your business collects between 833 and 100 in sales tax per month then your. Massachusetts local sales tax on meals. So you would simply charge the state sales tax rate of 625 to buyers in Massachusetts.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Meals are also assessed at 625 but watch out. In Massachusetts there is a 625 sales tax on meals.

In MA transactions subject to sales tax are assessed at a rate of 625. Premier investment. With the local option the meals tax rises to 7 percent.

Massachusetts imposes taxes on income sales and use meals and room occupancy corporate income and non-income measures other business income estates and cigarettes alcohol and marijuana among other things. The base state sales tax rate in Massachusetts is 625. Some jurisdictions in MA elected to assess a local tax on meals of 75 bringing the meals tax rate to 7.

The move comes as Massachusetts restaurant scene is partially shut down until at least April 6. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Businesses that collected less than 150000 in regular sales and meals taxes in the year ending on Feb.

The state meals tax is 625 percent. The meals tax rate is 625. Students present a valid Harvard student ID.

Find your Massachusetts combined state and local tax rate. Under Massachusetts law employees are entitled to a 30-minute meal break for each six-hour period that they work. How TurboTax Live Works.

Meals are also assessed at 625 but watch out. This blog provides instructions on how to file and pay sales tax in Massachusetts using form ST-9. Eligible businesses will be able to delay without penalty sales meals and room occupancy taxes for March April and May until June 20.

Military tax filing discount. Taxpayers can self-report safe harbor an estimated. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served.

Before August 1 2009 the tax rate was 5 Generally food products people commonly think of as groceries are exempt from the sales tax except. The tax is 625 of the sales price of the meal. Payments that have a status of In Process or Completed cannot be deleted.

Payments in MassTaxConnect can be deleted from the Submissions screen.

Massachusetts Sales Tax Small Business Guide Truic

Not Your Average Joe S Will Be At Feast In The Wild Employee Appreciation Party Average Joe Feast

Christina S Cafe Breakfast Brunch A Food Cafe

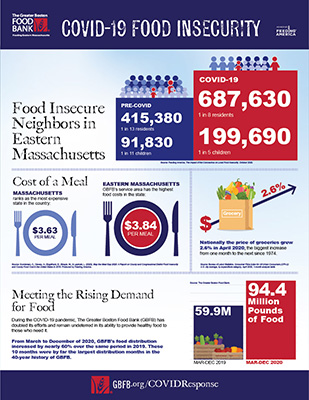

Food Insecurity Across Eastern Massachusetts At An All Time High

Metric Units And Common Imperial Units Mass Capacity Length Conversion Year 5 6 Worksheet Only Teaching Resources Metric Conversion Chart Chemistry Help Imperial Units

Pin On Small Business Finance Tips

Barnacle Billy S At Perkins Cove Ogunquit Maine Vintage 1969 Postcard Ogunquit Cove Ogunquit Maine

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Advance Payment Requirements Mass Gov

Exemptions From The Massachusetts Sales Tax

Massachusetts Could Make Free Breakfast And Lunch For All Students Permanent

C D L Vehicle Groups And Endorsements Trucking Life Cdl Trucks

Massachusetts Department Of Revenue Announces Updates To Relief For Certain Business Taxes Mass Gov

Pin By Mc On Isagenix Fast Food Places Isagenix Wine Bottle